Key Takeaways

- Staying vigilant for telltale signs of a scam, such as a family member exhibiting unusual financial behavior, secretive communication patterns, and emotional changes, is crucial for early detection and intervention.

- When addressing a potential scam with a family member, it’s important to choose the right moment, communicate with empathy and support, and avoid accusatory language to create a constructive and non-threatening environment.

- Active steps to disenfranchise the scam include contacting financial institutions, blocking scammer’s access to the victim’s information, reporting the scam to authorities, and bolstering security measures and vigilance to prevent future scams.

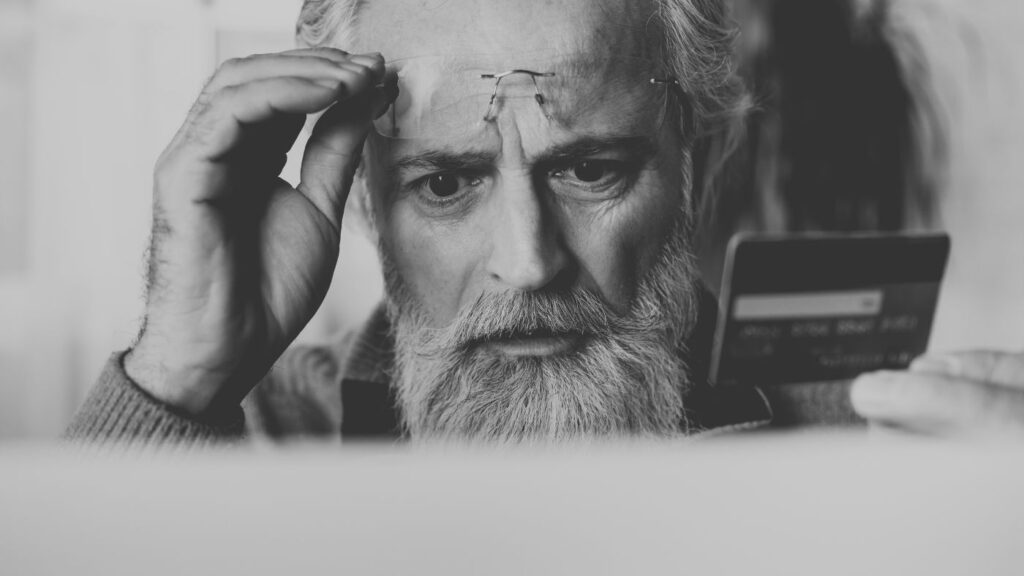

Detecting the Red Flags of Scams

The first step in thwarting a scam is to identify its signs. Scammers are skilled craftsmen, manipulating their victims with tactics like urgency, emotional appeals, and authority to prompt swift action. One should remain alert for any strange behavior changes in our family members, like changes in lifestyle, emotional withdrawal, or heightened financial secrecy, to prevent further scams.

Scams often leave a financial footprint. Unexplained withdrawals from bank accounts and large monetary losses are glaring red flags. We should also remember that we have the ability to take proactive steps to reduce the risk of scams. For instance, individuals in the UK can register with the Telephone Preference Service and the Mailing Preference Service to reduce nuisance post, junk mail, and phone calls.

Recognizing Unusual Financial Behavior

Keeping an eye on financial activities is vital for detecting scams. Unexpected transfers of money, frequent trips to the bank, or a sudden lack of funds can be indicators of a scam. Red flags include unexplained money transfers or an unusual number of bank visits. Alarm bells should ring when you notice these activities.

A common scamming technique involves the scammer overpaying for goods or services and then asking the excess amount to be wired back. If you see a family member engaged in this type of transaction or notice any other unusual financial activities, it’s time to step in and help them avoid losing more money to scammed scams by not allowing them to send money in such situations.

Spotting Changes in Communication Patterns

Communication patterns are another important aspect to monitor. A sudden increase in phone calls, particularly ones kept secret, could indicate a scam. The same applies to a sudden reluctance to discuss topics previously spoken about openly, such as financial matters.

Additionally, an unusual rise in social media usage on various social media sites could be indicative of a scam. If you notice any of these changes in a family member’s communication habits, it’s crucial to investigate further.

Emotional Changes to Look Out For

Emotional changes are also significant. Victims of scams often exhibit:

- Increased anxiety

- Embarrassment to talk about financial matters

- Fear

- Changes in mood

- Sleep disturbances

- Nervous behaviors

These could be warning signs of increased anxiety.

Fear related to being scammed can lead to a reluctance to engage with banking institutions or panic when receiving calls or mail that could be from scammers. Recognizing and addressing these emotional changes is crucial in helping the family member cope and in taking steps to intervene with the scam.

Initiating the Conversation with Care

After identifying the signs, it becomes necessary to express your worries. Yet, such a conversation demands a sensitive approach. It’s important to:

- Create a supportive environment

- Reassure the family member that their safety and security are the priority

- Use empathetic language

- Avoid talking down to them or raising your voice.

The conversation should be adjusted to suit their emotional state. Remember, they may feel embarrassed or defensive, so the topic of scams should be approached mindfully. The main goal is to understand the situation without rushing and establish whether they have been scammed, emphasizing their well-being above all.

Choosing the Right Moment

Selecting the appropriate time and setting for this conversation is of utmost importance. A quiet, private space where the family member feels at ease and without interruptions is ideal. This ensures an open, honest conversation and prevents public embarrassment.

Avoid broaching the subject in front of others or while the family member is engaged with the scammer. This could tip the scammer off or make the family member feel cornered. Remember, the aim is to make them feel safe and supported.

Using Empathy and Support

Empathy and emotional support are your best tools in this situation. They create a non-judgmental environment where scam victims can feel safe and understood. Empathetic communication reinforces their trust, helping them to open up without feeling judged.

By actively listening and asking open-ended questions, you can encourage victims to share their experiences in a secure setting. This encourages transparency and makes it easier to seek the necessary help.

Avoid Accusatory Language

It is vital to steer clear of blaming language. Accusing or blaming can make the family member feel guilty, which can hinder effective communication and resolution. Remember, the goal is to help them, not to make them feel worse.

Instead, use encouraging language that motivates them to take action and reassures them they are not alone. The aim is to make them feel supported and understood, which can go a long way in helping them recover and protect themselves in the future.

Taking Action to Halt the Scam

Following the initial dialogue, the next step is to act. This involves contacting financial institutions, blocking the scammer’s access, and reporting to authorities. This stage may be challenging, but it’s crucial for halting the scam and starting the recovery process.

Remember to take the following steps if you have been scammed:

- Cut off all contact with the scammer to prevent further manipulation.

- Find out what personal information has been compromised.

- If the scam involved sharing passwords, change them immediately.

- Check your accounts for any unauthorized changes.

Contacting Financial Institutions

Once a scam has been detected, the initial course of action is to get in touch with financial institutions. If money has been sent or account details have been shared, reach out to the family member’s bank immediately to put a block on any payments.

If credit card details have been compromised, report this to the credit card company immediately to prevent unauthorized transactions. If account or routing numbers have been disclosed, contact your bank without delay to potentially close and open a new bank account, ensuring the prevention of fraudulent activity.

Blocking Scammer's Access

Subsequently, blocking the scammer’s access becomes crucial. Here are some steps you can take to protect yourself from a scammer’s email address:

- Make sure that email addresses are not publicly posted.

- Enable two-factor authentication.

- Obfuscate the email address in communications to prevent easy harvesting by scammers.

Configure their phones to automatically send calls from unknown numbers to voicemail to decrease the chances of them answering scam calls. Also, enhance the security for social media and other online accounts by using app-specific passwords provided by their telephone provider.

Reporting to Authorities

Next, it is necessary to take the following steps to report the scam:

- Report the scam to the local police and the district attorney’s office.

- Report the scam to state financial regulators or the office of the attorney general, who may pursue state court actions against the scammers.

- Keep detailed records of the scam, including all communications and documentation of phone calls.

Early reporting to the authorities can increase the chances of recovering any stolen funds and apprehending scammers. This step is crucial to ensure that the scam is properly investigated and that legal actions are taken if necessary.

Preventing Future Scams

With the immediate threat managed, the focus should shift towards warding off future scams. This involves setting up stronger security measures, maintaining ongoing vigilance, and utilizing scam education resources. It’s important to discuss with seniors the specifics of common scams, including the signs to look out for.

Remember, prevention is better than cure. Encourage all family members, not just those who have been scammed, to improve their cyber security by overhauling weak passwords and using more complex ones. This step is crucial to prevent the recurrence of scams.

Setting Up Stronger Security Measures

Enhancing security measures constitutes a significant step towards prevention. Encourage family members to enable two-factor authentication on their online accounts for an added layer of security. The ability to add or remove additional trusted phone numbers provides a convenient way to ensure access even if the primary device is not available.

It’s also important to protect their identities by:

- Contacting credit companies to place fraud alerts

- Carefully managing their login credentials

- Secure storage of critical paperwork, like property deeds and wills

- Using strong passwords and security software for financial accounts

These measures can prevent unauthorized access and ensure the security of personal information for federal agencies.

Ongoing Vigilance

Continuous alertness plays a crucial role in ensuring safety. After reaching out to a bank about a scam, it’s recommended to stay vigilant and monitor accounts for any unauthorized transactions. Regularly reviewing and updating privacy and security settings on social media apps can also protect against new scams. Implementing a fraud alert system can be an additional measure to safeguard your financial information.

Regular wellness visits can help monitor the victim’s situation and provide education on potential scams to protect their well-being and financial interests. It’s always better to be safe than sorry, and ongoing vigilance can prevent a lot of harm.

Scam Education Resources

Education about scams serves as a potent tool for prevention. There are dedicated scam education resources available for families to assist in learning about online scams and fraud. Interactive guides and step-by-step controls on popular social media platforms are among the resources offered to educate individuals on recognizing and preventing online scams.

Educating victims can reinforce their trust and provide guidance and support. This can be achieved by having experts from financial institutions or cybersecurity organizations provide guidance and support in scam education.

Offering Continuous Support

Providing constant support forms an integral part of the healing process. Victims of scams may experience feelings of betrayal due to deceit, which can affect their trust in others. Providing emotional support involves being patient, offering a partnership for oversight, and seeking outside help as needed.

The aim is to help them regain their emotional resilience and self-trust. Encourage open dialogue by letting the loved one know you are there to talk about their feelings resulting from the crime, and if they prefer, to talk to someone else like a trusted friend or counselor.

Providing Reassurance

Giving assurance constitutes a crucial aspect of extending support. Using non-judgmental language is critical to avoid making the scam victim feel further victimized or blamed for what has occurred. The goal is to make them feel understood and supported, not to make them feel worse or embarrassed.

Reassure the family member that:

- Scammers are skilled professionals and they are not alone in falling victim to scams

- Let them know you’re there to help them take steps to resolve the situation

- Avoid shaming or blaming them

Professional Help

Victims of scams, who have fallen victim, can greatly benefit from seeking professional help. It’s important for them to seek advice from professional counselors, as it is vital for victims to acknowledge and process their emotions, which is a crucial part of the healing process and regaining the ability to trust.

Support groups provide a structured environment that helps scam victims overcome the challenges associated with rebuilding trust. These resources can provide invaluable help to victims, providing them with a supportive community and professional guidance to navigate their recovery.

Building Trust

Lastly, concentration should be laid on fostering trust. Introducing scam victims to others who have endured similar scams can provide them with reassurance and diminish the sense of being alone in their experience. Establishing healthy boundaries is a crucial step in the process of rebuilding trust between the family member and their support network.

Engaging in activities that promote connection and a sense of community can help restore the family member’s trust in others and in themselves.

Summary

In conclusion, being scammed is a traumatic experience. The emotional and financial toll can be overwhelming. But with alertness, empathy, and the right tools, we can help our loved ones navigate this challenging situation. We’ve covered recognizing the signs of a scam, initiating the conversation with care, taking action to halt the scam, preventing future scams, and offering continuous support.

Remember, the aim is not just to recover from the scam, but also to build resilience against future scams. Knowledge is power, and with the right resources and support, we can help our loved ones shield themselves from scammers. Let’s take these steps together, because together, we are stronger.

Frequently Asked Questions

What to do if a family member has been scammed?

Report the scam to the local police as soon as possible and seek their specific advice on next steps.

How do you recover mentally after being scammed?

To recover mentally after being scammed, accept your emotions, seek support from friends and family, practice self-care, and change your thinking pattern to avoid self-blame. Remember, being scammed does not make you stupid.

What is the emotional trauma of being scammed?

The emotional trauma of being scammed can lead to feelings of shame, anger, and betrayal. Seeking support from friends, family, or a therapist, and educating oneself about scams can help in dealing with this trauma.

What to do if an elderly person gets scammed?

If an elderly person gets scammed, report the incident to the appropriate authorities such as the local FBI field office, and keep all related documentation. You can also seek support by contacting Eldercare Locator at 1-800-677-1116.

What do you say to someone who has been scammed?

It’s not your fault that you got scammed. Scammers can trick anyone. Make sure to report the scam to the appropriate authorities as soon as possible.